Sydney and Melbourne Auction Rates Signal Stabilising Market

The trend of strengthening auction results continued this week, but the real test will be in coming months as the results of credit loosening and tax and cash rate cuts are meted out.

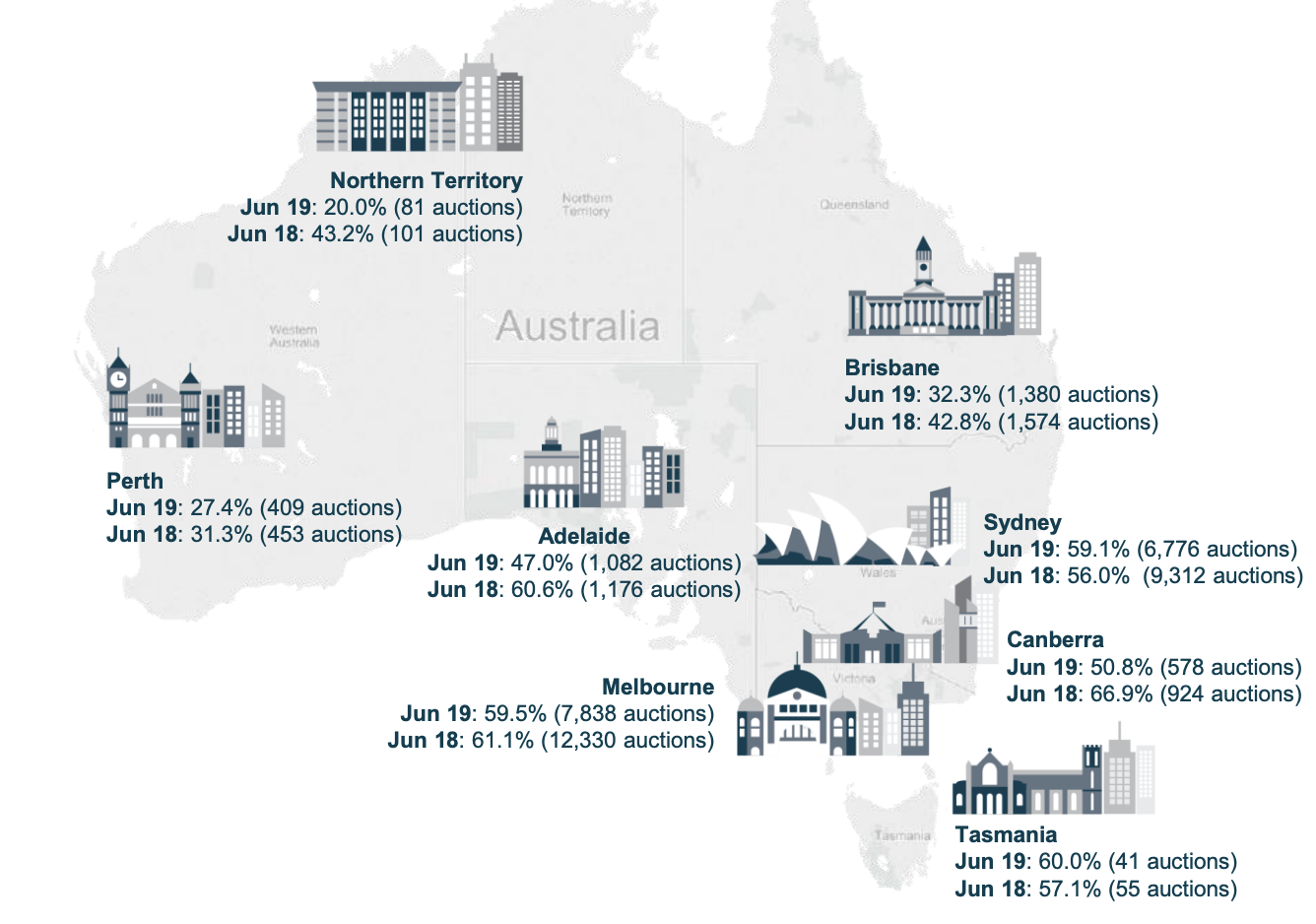

Corelogic’s quarterly auction clearance rate figures showed auction results for the June quarter outperforming both the June 2018 quarter and the first quarter this year.

The trend toward higher clearance rates has been most pronounced in Sydney and Melbourne, at 77.2 per cent and 73.6 per cent respectively, compared to 46.9 per cent and 56.2 per cent a year earlier.

“The improved trend in auction market results provides further evidence that housing conditions are stabilising, especially in Sydney and Melbourne, where a trend towards higher clearance rates has been most pronounced,” Corelogic research analyst Cameron Kusher said.

Over the three months to June, combined capital city clearance rates held above 50 per cent for 11 of the 13 weeks and above 60 per cent for the past three weeks.

“It will be interesting to see if this continues,” Kusher said.

Related: Regulators Positive About Housing Market Recovery

Strongest auction results: Suburbs, June quarter

| City | Suburb | Results % | Scheduled Auctions | Number sold |

|---|---|---|---|---|

| Sydney | Lane Cove | 91.7% | 32 | 22 |

| Melbourne | Armadale | 85.7% | 33 | 24 |

| Brisbane | Camp Hill | 48% | 26 | 12 |

^ Clearance rates calculated where there has been at least 20 results reported over the period.

Low auction volumes remain cause for concern — with 18,104 auctions a significant 30 per cent lower than the same time last year. In comparison, the March quarter saw 14,647 auctions.

“Although the March quarter is traditionally quieter due to the seasonal slowdown in January, so lower volumes is not that surprising,” Kusher said.

Highest number of auctions: June quarter

| City | Suburb | Auction volumes |

|---|---|---|

| Melbourne | Reservoir | 132 |

| Sydney | Mosman | 76 |

| Brisbane | Wynnum | 27 |

| Adelaide | Prospect | 19 |

| Perth | Duncraig | 13 |

^Based on total auctions held across the suburb over the reporting period.

REA Group chief economist Nerida Conisbee said that while demand has started to increase, there has been no substantial uplift in the number of properties listed for sale.

A promising increase in residential indicators, such as a bump in realestate.com.au search activity and improving clearance rates may still be offset by global headwinds and rising unemployment.

“While many economic indicators have been poor for some time now, the bright spark has always been low unemployment,” Conisbee said.

“With this creeping up and the Reserve Bank pushing through two interest rate cuts very quickly, the positive effect of cheaper finance may not be enough to offset the fact that people are beginning to lose their jobs.”