‘Bounce Back’: Sydney and Melbourne Housing Markets Lead Price Growth

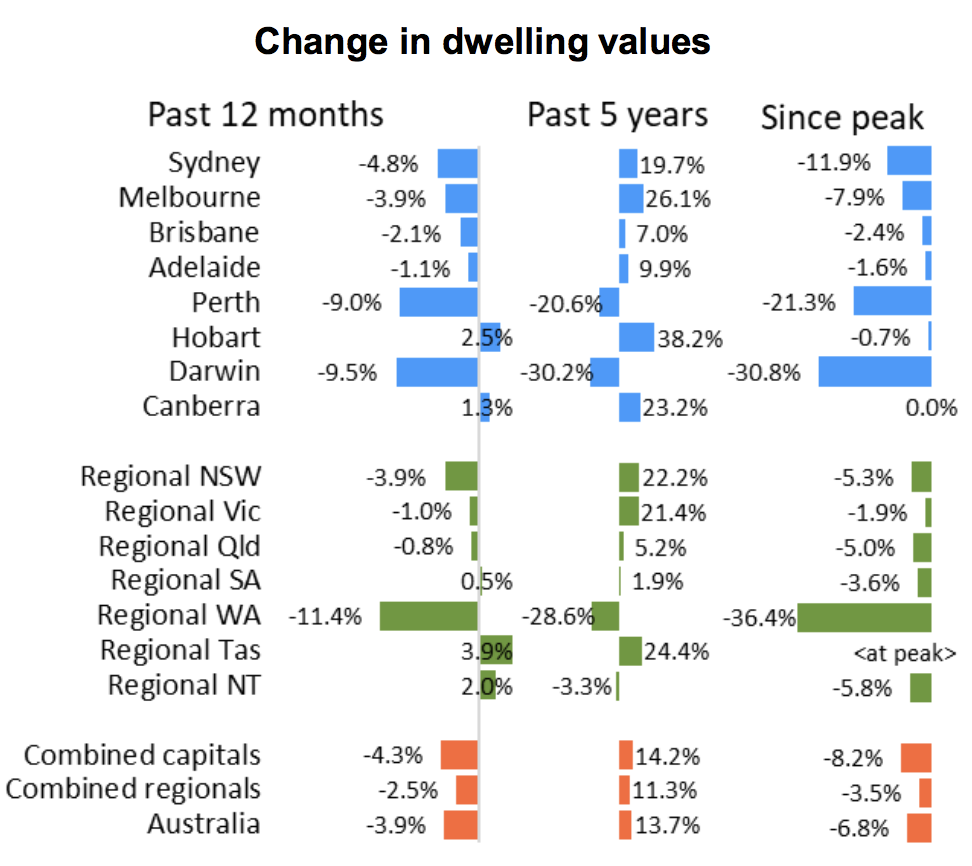

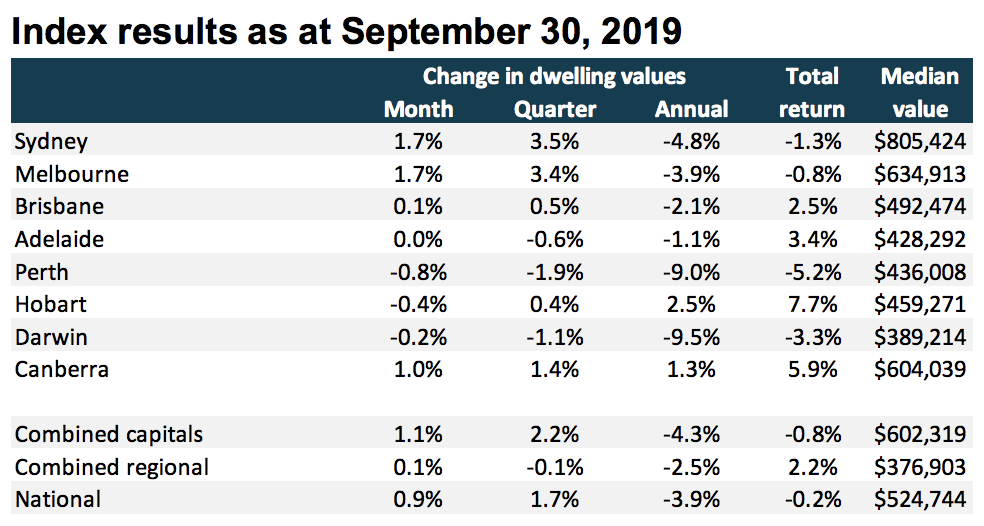

Australia’s two largest cities have seen a bounce-back in home values over the past two months, with Sydney recording a cumulative rise of 3.3 per cent and Melbourne up 3.2 per cent over August and September.

Corelogic says the September housing market results offer “further confirmation” Australia’s housing market recovery “is in full swing” across the two major capital cities, while the remaining capitals and regional areas show “a mixed result”.

Speaking on the Reserve Bank of Australia's monetary policy decision on Tuesday, in what is the third interest rate cut this year, RBA governor Philip Lowe said that there were “further signs of a turnaround in established housing markets, especially in Sydney and Melbourne”.

A trend towards higher unemployment and a slowdown in jobs growth were the primary factors in the RBA’s decision to cut interest rates 25 basis points to the historic 0.75 per cent low, a move largely in line with expectations.

Across Australia's housing markets, Brisbane and Canberra were the only other capital cities to record a slight rise in values over the month of September.

While values held firm in Adelaide, a slight 0.4 per cent fall was recorded in Hobart, and falls recorded in Perth and Darwin, according to the monthly hedonic home value index.

Sydney and Melbourne saw dwelling values rise by 1.7 per cent in September.

Lawless said the strong rebound in Sydney and Melbourne housing markets relative to other regions could be attributed to a “variety of factors” including rising auction clearance rates and a rise in buyer activity.

“While all regions are benefiting from low mortgage rates and improved access to credit, economic and demographic conditions in New South Wales and Victoria continue to outperform most areas of the country,” Lawless said.

“Population growth is higher, unemployment is lower and jobs growth is stronger, providing a solid platform for housing demand.”

Corelogic data shows that the number of listings across the capital cities is 10 per cent lower than a year ago, and fresh listings being added to the market are 15 per cent lower than a year ago.

Tuesday figures released by SQM Research showed property listings dropped by 4 per cent in September (312,754) from August (325,693) in what SQM's Louis Christopher described as “an abnormal result” for the first month of Spring.

Last week the RBA said that weak growth in household spending was partly due to the housing market adjustment, with the decline in housing turnover down to the lowest level in “more than 20 years”.

And while improved housing values and activity will help boost sentiment and fuel spending, Lawless said household debt levels reached new record highs relative to incomes over the June quarter.

“Suggesting the sector is vulnerable to a shock or change in household circumstances,” he said.

Australian Bureau of Statistics housing finance data to July shows investors make up 32 per cent of mortgage demand across New South Wales and 26 per cent of mortgage demand in Victoria.