Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

A scarcity of large inner-city development sites in Sydney is driving strong performance with $4.5 billion in unplaced capital in the market, according to Colliers.

The NSW Residential Development Sites team has transacted more than $1.5 billion in deals in the first half of 2022 in core inner-city Sydney locations with a further seven deals in the pipeline.

But the voracious appetite of developers hunting for large sites was unable to be satisfied, according to Colliers national director of residential Guillame Volz.

Volz said larger sites that could accommodate 300 or more apartments in core development areas including St Leonards, Chatswood, the inner West and South Sydney, were in hot demand.

He said it was the scarcity of large development sites that was driving high volumes of enquiries and the strongest performance in the large-site market in seven years.

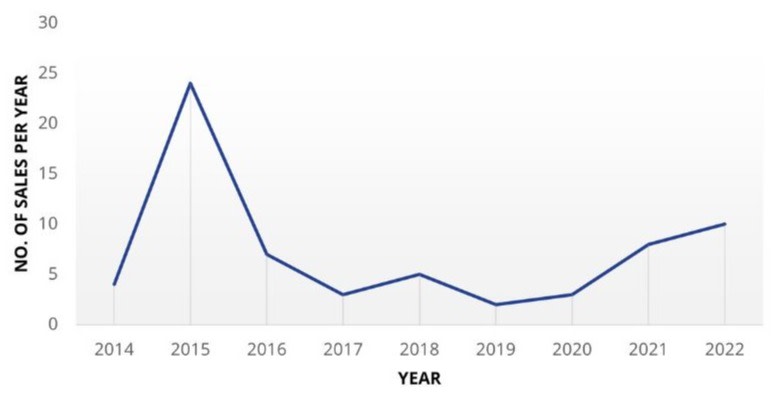

“The large site market is the strongest it has been since 2015 where 24 $100m sites were sold in one calendar year, with eight sites sold in 2021 and over 10 sales likely this year,” Volz said.

“[The 2015 high] was triggered by low supply levels as well as new entrants, largely Chinese, appreciating the value that the Sydney market offered.

“Whilst 2021 was certainly buoyed by the stimulus that low interest rates provided, the development landscape has been plagued by an ongoing deficit that has slowly been getting worse since 2017.

“Developers are ultimately confident that low supply levels will result in strong market conditions when sentiment turns again.”

Volume of large residential development site transactions

But it is firmly onshore capital in the market now.

Volz said the buyers were predominantly builder-developers looking to pad out their pipeline of work, and private buyers taking a longer-term view on the increasing demand for apartments in Sydney.

“It’s really about securing good land in good areas and taking a longer-term view on low rental vacancies and the high price of housing, and the fundamentals driving the apartment market.”

Of the $1.5 billion in sales this year there were five major $100-million-plus sites in core inner-city locations, according to Volz.

This included Coronation Property’s $315-million acquisition of Park Sydney at Erskineville, a 4.423ha masterplanned site with approval for about 1000 apartments.

Colliers national director of residential development sites Henry Burke said Park Sydney was an “aggregation play”.

“While [it had] an approval in place and potential for 1000 apartments in a prime inner-city location where approvals are getting harder, the site offered a significant pipeline rather than having to piece together the equivalent supply from five smaller sites, which alone are also difficult to acquire,” Burke said.

Sydney is the most undersupplied market in Australia and falling well short of its targeted 36,250 dwellings a year.