This Year It is More About the Question You Ask Than the Answer You Get

As we dust the summer sand from our feet, it's time for us here at The Urban Developer to slip out of holiday mode and get serious about what awaits us in the year ahead.

Since I started in this industry, more than a decade ago, I've always been fascinated by the complex nature of property.

By virtue of its design as a series of “markets within markets” , the broader property market reminds me of a biological ecosystem.

One in four Australians work either directly or indirectly in the property industry, and more than $7 trillion of our national wealth is tied up in residential property alone, making it truly the engine room of the economy.

So, what can we all expect from the year ahead in property?

At this time of year, I usually have a pretty good sense of what to expect. But this year is a bit different.

I'm going to be completely honest here. I really don't know what's going to happen!

There's a lot of waves rolling in and I don't know whether I am going to catch a monster or get dumped. (PSA: I can't surf).

So rather than trying to answer the questions, I feel it's more important to be precise about the questions that we're asking.

So, here goes...

The economy

In my opinion, the big question we need to ask in relation to the economy is this: To what extent is a slowdown in the housing sector likely to impact the broader economy?

It seems that the senior economists around the country are split like a banana in their thinking on this issue.

The optimists are confident that the Australian economy — with low unemployment, strong jobs growth, positive GDP growth, low interest rates and major infrastructure investment — is well placed to ride out this “sensible recalibration” of housing values in Sydney and Melbourne.

The pessimists in the bunch are concerned that, with so much of the nation's wealth tied up in residential property in our two biggest markets, that a sudden decrease in values will not only take the wind out of the market's sails, but take a knife to the sail itself.

The jury is still out on this one, however I'm leaning more towards the optimists, but with a little bit of pain in the short-term.

The banks

After getting the proverbial beaten out of them by the heavyweight Hayne Royal Commission, Australia's major banks are in recovery mode.

While it will take some time for the swelling to go down and the cuts to heal, the Royal Commission will create scar tissue that will ultimately make the banking sector stronger and hopefully rebuild trust in these important and necessary institutions.

I reckon the big question is this: When are we going to see banks open the doors again to “normal” lending conditions, particularly to residential property investors? Is the end of the Royal Commission the clear air we need to get on with it, or are we in for another six months of choppy waters?

I'm leaning towards an environment of churn until we get through the federal election as the issue will be a political battleground.

The back half of this year is hopefully the time when we can all get on with it.

Interest rates

I'm not an economist however it's obvious that the rhetoric coming out of the Reserve Bank of Australia has softened since the housing market cooled dramatically in the final quarter of last year.

The question of when has now turned into a question of if interest rates will rise.

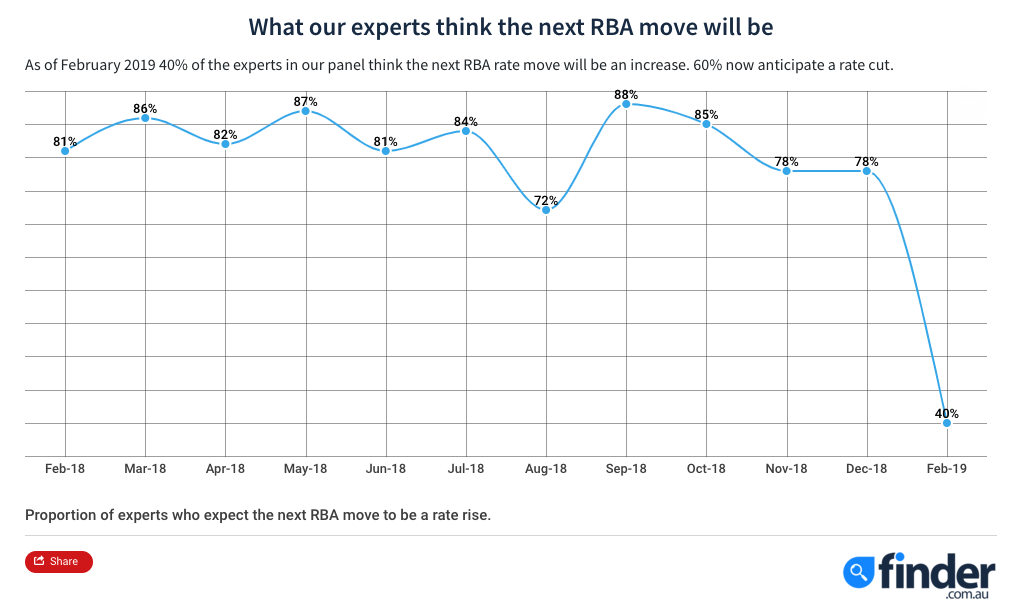

According to a survey of over 30 economists by Finder.com.au, the likelihood of a rate rise as the next RBA move decreased from 88 per cent in September 2018 to 40 per cent in February 2019.

This means that 60 per cent of respondents believe the next RBA move is down!

Your guess is as good as mine on this issue, however my question in relation to interest rates is this: Can my project or investment handle a movement of 1-2 percentage points either way over the next 2-3 years?

Federal politics

I can't help but feel that this year's federal election is going to get nasty. With so much on the line for all parties, there will be no holding back.

The Libs are going to throw bucketloads of cash at marginal seats to retain them, while Labor will ramp up its election promises with an expansive expenditure plan and some defining policies for the property industry — notably, negative gearing, dividend imputation, infrastructure, social housing and capital gains tax reforms.

I think the election will be closer than we all think, however it feels like the electorate is wanting change for the sake of change.

Saying that, crazier things have happened, so it's anyone's guess!

The questions for my mind: How do the policies of each party directly affect my portfolio? What opportunities will new policies create for the industry? How will the policies combine to impact the sentiment of buyers and investors? Will population policy be impacted? Will infrastructure spending continue?

_____