Over the past two months, economic and housing market indicators have been fairly subdued despite showing improvements since April.

A rise in sales over May saw a strong absorption of new listings, clearance rates have rebounded since the easing of restrictions, and consumer confidence has rebounded 33 per cent since its trough in May.

However, comprehensive coverage of labour markets from the Australian Bureau of Statistics highlights sobering headwinds for the property market.

Job and income levels are likely to remain subdued as mortgage holidays expire and stimulus measures are wound back.

Rental markets are expected to be particularly dampened by disproportionate job losses among young people, and those working in tourism, hospitality and the arts.

Between March and May, ABS labour force data indicated that 835,000 fewer people were employed across Australia.

The unemployment rate rose to 7.1 per cent in May, while the under-employment rate reduced from a recent high of 13.8 per cent in April to 13.1 per cent in May.

While it may seem counter-intuitive, it is not uncommon for some housing markets to perform well when unemployment rises.

That is because when unemployment surges and the economy weakens, the monetary response has been to lower the cash rate.

The cheaper cost of debt actually creates growth in housing for those who can still afford to buy.

The chart below shows the monthly unemployment rate against the monthly growth rate in national dwelling values.

Unemployment rate v growth rate in house prices

^Source: ABS. CoreLogic

However, data over May shows the historic relationship between the unemployment rate and housing market performance has deteriorated.

As the unemployment rate hit its highest level in almost two decades, the monthly change in housing values was negative. This is despite the cash rate reaching a record low, and RBA data suggesting average new mortgage rates were just 2.8 per cent for owner occupiers, and 3.2 per cent for investors over April.

This may be a function of unemployment being too widespread to enable low interest rates to stimulate housing market conditions.

Another contributing factor could be a shift in investor expectations; with falling cash rates a major contributor to future capital growth, housing assets may be less appealing to investors as the cash rate hits a record low.

Another important implication from the back series of the unemployment rate is to note how relatively high levels of unemployment were sustained after the Global Financial Crisis in 2008, rather than unemployment returning to pre-GFC levels.

As with the GFC, structural changes in the economy amid Covid-19 are likely to see the unemployment rate elevated for some time.

Businesses who have found ways to operate through the crisis may not need to re-hire as many staff.

This suggests that over the next year or so, lasting, loosened conditions in the labour market could dampen demand for housing.

With the cash rate now at a record low, recovery in incomes and jobs will be necessary to increase purchasing capacity.

Analysis from the RBA suggests that a 1 percentage point increase in the rate of unemployment can lead to an increase in the mortgage arrears rate of about 0.8 percentage points. At November last year, the mortgage arrears rate in Australia was about 1 per cent.

However, this research is based on historic data. The unemployment rate does not capture the full extent of labour market conditions, because it only factors in people who are actively looking for work.

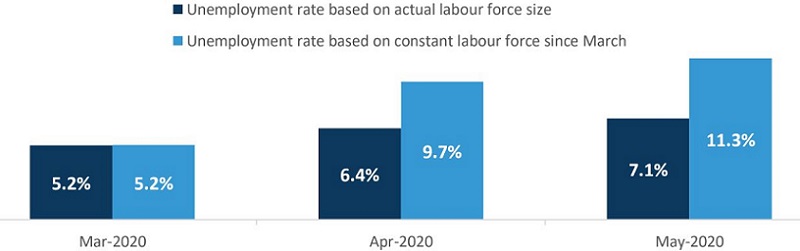

ABS data suggests that the recent reduction of people employed was about 835,000 people between March and May. But only about 212,000 additional people were unemployed, and looking for work in the same period.

This has created an abnormally large drop-off in the participation rate, which is the portion of employed and unemployed people actively engaged in the labour force, divided by the entire population aged over 15.

The implication is that the unemployment rate and arrears rate relationship may be thrown off by the significant reduction in the participation rate.

If the size of the workforce had stayed steady since March, the May unemployment rate would be 11.3 per cent. At face value, this suggests that an increase of 1 percentage point in the unemployment rate may have more of an impact on arrears. However considering the composition of job losses amid Covid-19, the direct risk to property may be offset to an extent.

Unemployment rate in Australia

^Source: ABS

Though labour market conditions have significantly deteriorated, many of the job losses seen over the past few months may not present a direct risk to the housing market. That is because many of those who have suffered job loss, are also less likely to hold mortgage debt.

For example, of 59.7 per cent of the decline in the number of people employed between March and May were across those in part-time work. About 40 per cent of the decline in total employed were among those aged between 15 and 24.

Given the typical first home buyer is aged 25-34, it is unlikely many of those who have lost work in this age group would have mortgage debt.

Additionally, ABS analysis of payroll data suggests the biggest declines in employment by sector are across tourism, accommodation and the arts.

Workers with these characteristics are less likely to hold mortgage debt than older workers in industries such as professionals, service workers and trades.

The economic impact of these job losses is still significant, and will impact the housing market indirectly, even if young people and those in tourism, hospitality and the arts, are less likely to hold mortgage debt. That is because they are more likely to rent.

So the current declines in employment will likely have an indirect impact on housing prices, through weaker rental demand and downside risk for higher rental vacancies, lower rents and deteriorating yields.

The RBA has noted on several occasions that improvements in the labour force will not be a mere waiting game.

Re-employing those who have lost jobs will require greater innovation and education reform. Based on recent data, such policies will also play an important role in increasing housing demand.