Apartment Approvals Jump 16pc in September

In the latest positive economic indicator of a turnaround in Australia’s property markets, building approvals rebounded in September, led by apartments with a volatile 16.1 per cent jump for the month.

New housing approvals recorded a 7.6 per cent improvement, and while attached dwelling approvals—flats, townhouses and apartments—posted the largest monthly increase, it is expected to be short-lived with approvals still trending downward.

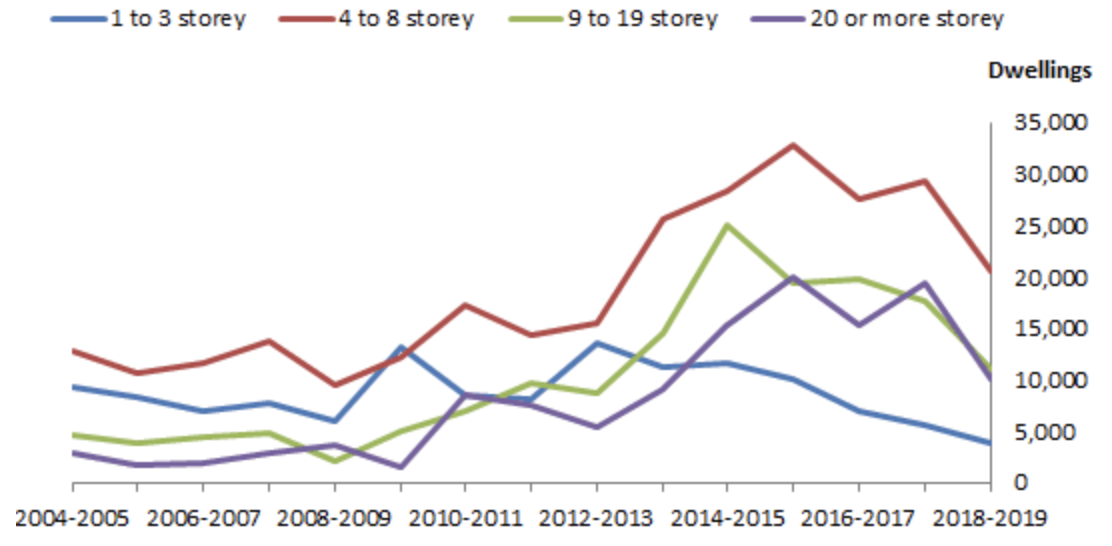

Total approvals remain 21.1 per cent lower than the same time last year, and apartment approvals have fallen by 44 per cent to 46,110 in 2018-19—the lowest since 2012-13.

The decline is even more stark for buildings of 20-storeys or more which have nearly halved in the 2018-19 financial year, falling from 19,369 approvals to 10,467.

Since the peak of the apartment approval boom in 2015-16, low to mid-storey apartment approvals—four to eight levels—have declined 37.1 per cent, while mid-storey apartments of nine to 19-levels have recorded a 43.4 per cent fall.

The lag between approvals and construction can stretch out to as much as 18 months, which means it is still too soon to confirm that we have passed the bottom of the cycle, HIA chief economist Tim Reardon points out.

“But this result is another indication that the market is stabilising,” Reardon said.

Related: Constrained Supply Sparks Rosier Outlook for Developers

Apartment approvals, ABS

Detached housing figures increased 2.7 per cent compared to the previous month, but approvals for the September quarter remain considerably lower than a year earlier.

HIA’s new home sales figures showed an uplift for the second month in a row, with improving house prices, low interest rates and an easing in mortgage serviceability guidelines helping the residential market regain its footing.

“However, it is not until June quarter next year that these measures are expected to drive sustained growth in dwelling approvals,” BIS principal economist Tim Hibbert said.

On a state by state basis, Queensland made the largest improvement with a 19.6 per cent jump in approvals, with Victoria (3.3 per cent), South Australia (16 per cent) and Tasmania (3. 4 per cent) all recording jumps in September.

Queensland apartment approvals recorded the largest peak-to-trough fall, with only 2,427 high rise apartments approved in 2018-19—a 76 per cent decrease from its 2015-16 peak of 10,111 apartment approvals.