Housing Capital Gains Losing Steam Despite Rise in Dwelling Values: CoreLogic

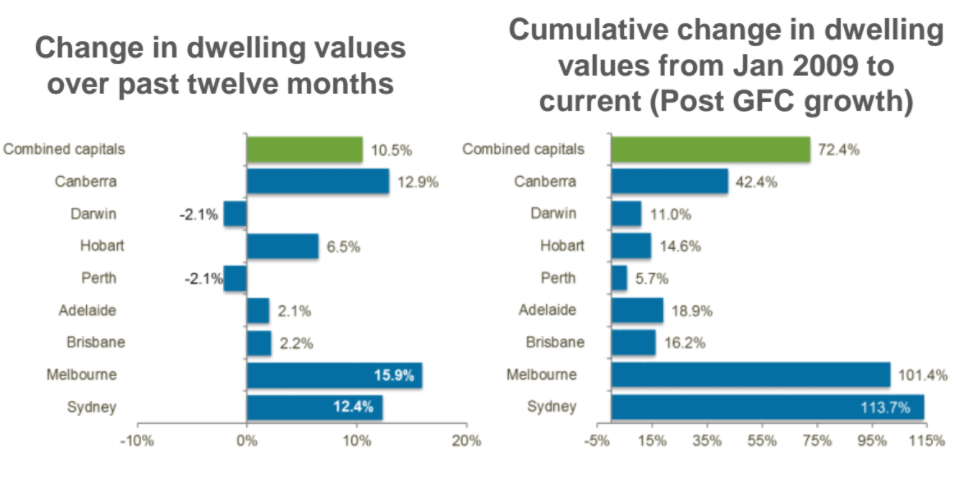

Dwelling values across Australia's capital cities have risen 1.5% this month, according to the July 2017 CoreLogic Home Value Index.

CoreLogic's monthly index revealed that the housing market is gradually responding to higher mortgage rates, tighter credit policies and affordability challenges, with the quarterly trend in capital gains moderating relative to early 2017.

The latest housing market results highlighted the diversity of housing market conditions, with dwelling values down over the month in Brisbane (-0.6%), Perth (-1.3%) and Darwin (-1.2%).

“The recent bounce in capital gains may be partially due to a recovery from the seasonal slump in values recorded in April and May," CoreLogic Head of Research Tim Lawless said.

"However other factors, such as stamp duty concessions for first home buyers in New South Wales and Victoria, may also be having a positive impact on market demand.

“It’s still too early to measure the effect of first home buyer incentives, which went live on 1 July. Historically, the first time buyer segment has been very responsive to stimulus measures," he said.

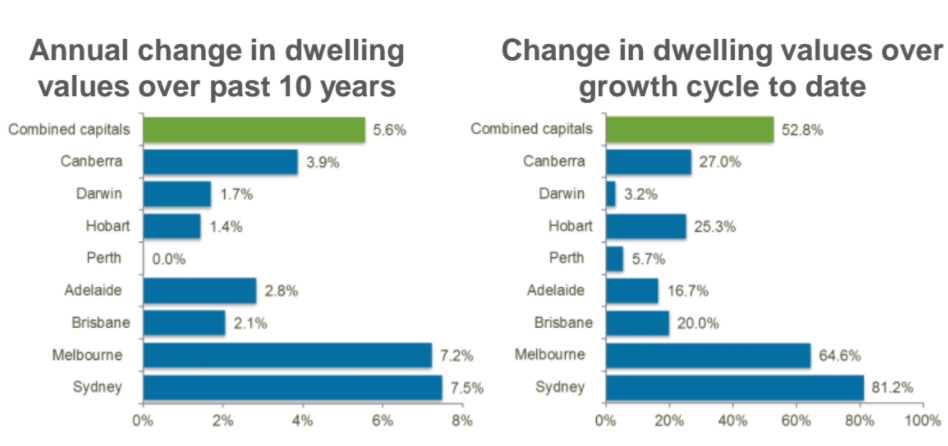

The rolling quarterly pace of capital gains across the combined capitals has fallen from 3.6% in February earlier this year to reach 2.2% at the end of July.

The slowdown in growth conditions was evident across the hottest markets, with the quarterly growth trend reducing from 5.0% in Sydney earlier this year to 2.2% at the end of last month.

Melbourne growth conditions have also slowed, though to a lesser extent, with growth easing from a 2017 quarterly peak of 5.5% to 4.2%.

“Melbourne appears to be benefitting from consistently high population growth which is creating strong demand for housing, as well as consistently high jobs growth and more affordable housing options relative to Sydney," Lawless said.

At the other end of the growth spectrum, Perth and Darwin continued to see dwelling values slip lower over the month, taking the cumulative decline to 10.2% in Perth and 14.5% in Darwin since both markets peaked in 2014.

The ease in the rate of decline was especially visible in Perth, providing a signal that the Western Australian capital may be approaching the bottom of the downturn; listing numbers have been falling across Perth - indicating improving conditions - and transaction numbers have found a new floor at around 2,500 sales per month.

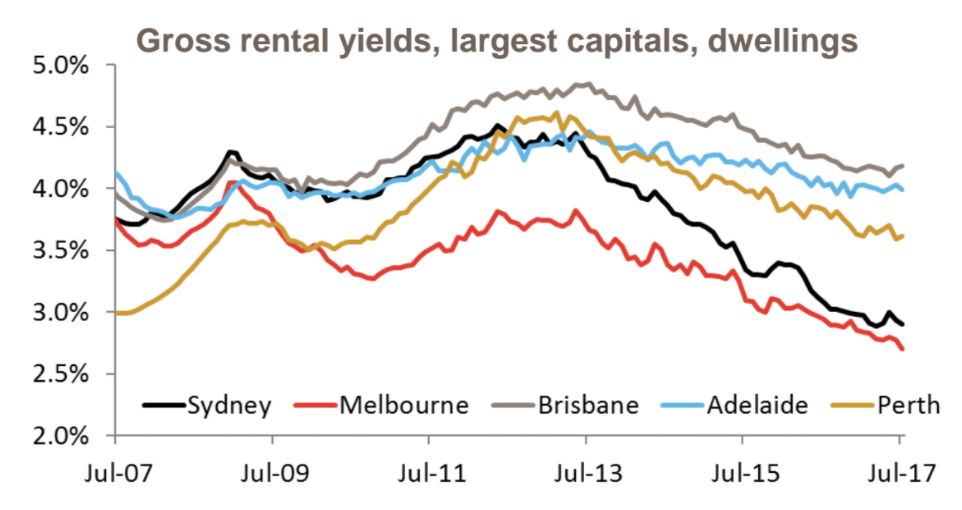

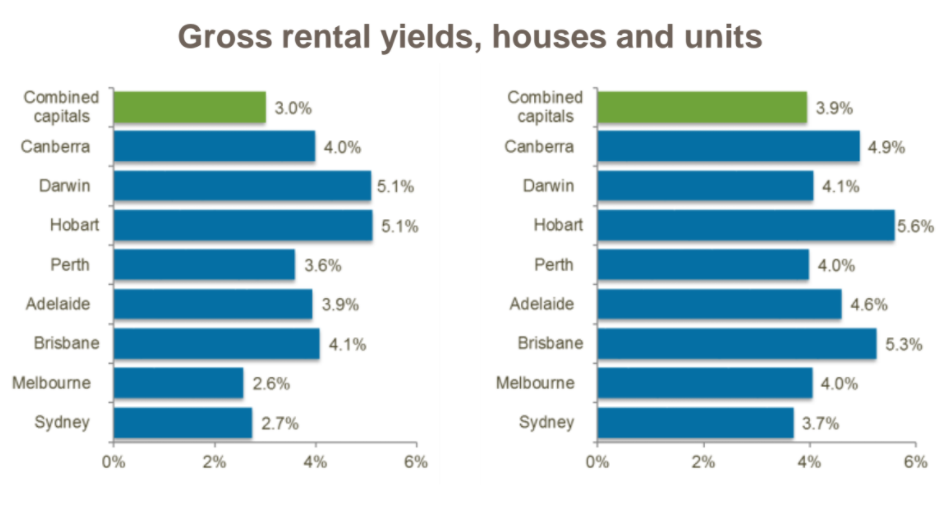

The rise in dwelling values across the combined capitals over the month has not been matched by a rise in weekly rental rates, which means gross rental yields have slipped lower over the month. Gross yields are once again at new record lows across the combined capital cities, driven by further falls in yields across both Melbourne and Sydney.

Across the combined capitals, the gross rental yield on a dwelling is now 3.1% with the lowest yields in Melbourne (2.7%) and Sydney (2.9%).

Over the past five years, gross rental yields have compressed across every capital city apart from Hobart where yields are unchanged at a reasonably healthy 5.2%. The most substantial decline in rental yields has been in Sydney, where dwelling values are up 77.3% compared with a 15.5% rise in weekly rents.

While the housing market has slowed from the recent highs of late 2016 and early 2017, the trend rate of growth remains robust.

“I don’t think there is any one factor causing the market to lose steam, rather it is the culmination of several factors working together," Lawless said.

“Higher mortgage rates and tighter credit policies have dented investor appetite. This is clear from the RBA’s monthly credit aggregates which show investment related housing credit growth has consistently slowed from late last year.”

Lawless said that higher mortgage rates are now also impacting on interest only loans as well as fixed rate loans which is likely to further disincentivise some prospective buyers.

Considering household debt levels are at record highs, rises in the cost of debt will likely have an amplified effect on household decision making. At the end of June, discounted variable mortgage rates were up 15 basis points for owner occupiers and were 35 basis points higher for investors.

“More choice for buyers implies less urgency which may be easing upward pressure on prices," Lawless said.

“Affordability challenges are also likely to be impacting buyer demand across Sydney, where the median house price remains over $1 million.”

The pace of capital gains is expected to continue to ease through 2017, particularly in Sydney, and to a lesser degree Melbourne, where value growth has been most extreme over the past five years.