Commercial Deals Slump 80pc in First Quarter

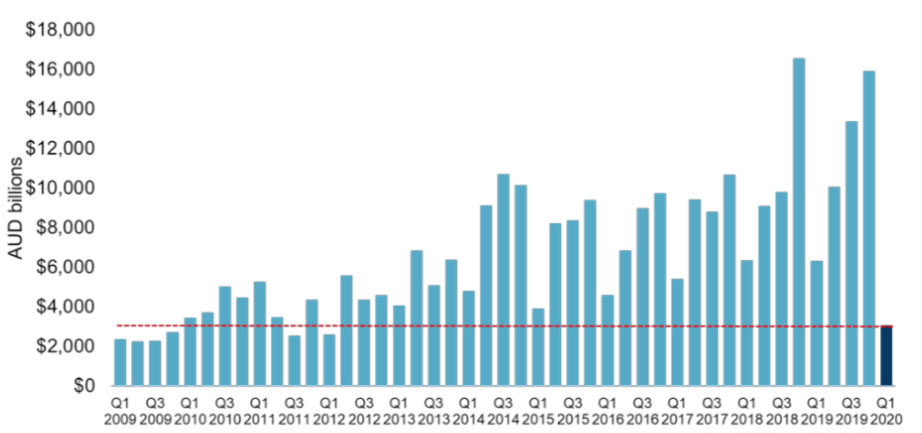

The profitability of commercial property investments is set to be tested over the coming months after an 81 per cent drop off in transactions— the lowest quarterly volume since 2012—was recorded last quarter.

According to new data from Cushman & Wakefield, the slowdown in major commercial real estate deals was put down to softening investor confidence in the wake of the coronavirus outbreak coupled with as an absence of large portfolio transactions.

Commercial real estate investment dropped to $3 billion over the quarter, down from $15.9 billion in the fourth quarter of 2019—which was the second strongest quarter on record.

Cushman & Wakefield chief executive James Patterson said the impacts from the coronavirus situation was continuing to be felt across all areas of the economy.

“For the commercial real estate sector, it is undeniable that uncertainty around the length and extent of the pandemic is leading to restricted or delayed investment decision-making which has weighed significantly on investment volumes.

“However, at this stage we aren’t seeing assets brought to market as a result of vendor distress which is encouraging.”

Related: Petrol Stations, Student Housing Top Commercial Deals

Australian commercial real estate quarterly transaction volumes

Escalating international travel restrictions to counter the spread of the virus also weighed on foreign investment, representing 22 per cent of all investment across the quarter, compared to an average of 42 per cent across 2019.

National investment activity was led by the office market, with $1.6 billion in deals transacted representing 54 per cent of the total, down 78 per cent quarter-on quarter from $7.3 billion.

Despite office towers across the country being abandoned, with most non-essential workers now working from home offices, many investors remain firm on the temporary nature of the shutdown and the remaining record low vacancy rates in Sydney and Melbourne's office markets.

Despite the low number of transactions over the quarter, a number of high-profile transactions are expected to settle soon.

These include the $950 million sale of 39 Martin Place by Macquarie to ISPT, the $366 million settlement of GIC’s additional 24 per cent interest in the Dexus Australian Logistics Trust and Poly’s $290 million investment in 59 Goulbourn Street.

Retail property stocks have been savaged and average retail property returns are forecast to take a hammering over coming months as foot traffic declines due to the federal government's social distancing measures.

Over the quarter $730 million worth of transactions recorded, compounding the problem within the sector where bricks and mortar have been in a long-standing battle by the growth of online shopping.

Industrial property recorded $524 million in transactions, partly buoyed by an uplift in e-commerce, but experts have warned it could quickly become affected by supply chain disruption.

“While the outlook remains uncertain, the Australian commercial property sector was in excellent shape going into this black swan event, and those strong foundations have the potential to underpin a strong eventual recovery for the sector,” Patterson said.

Sydney's commercial sector sweats

Office investment volumes in NSW, which recorded a total of $10.2 billion in the 2019 financial year, were also down 86.5 per cent quarter-on-quarter to $579 million as risk continues to rise and debt dries up.

Transactions, which up until recently were buoyant in Sydney's metro markets, have contracted sharply, as nervy investors retreat in the wake of the savage global shock caused by the coronavirus pandemic.

According to Cushman & Wakefield, over the recent quarter, investment in total commercial real estate assets in NSW declined by 82 per cent to $1.1 billion, down from $6.3 billion in the fourth quarter of 2019 and 58 per cent lower than the same time last year.

Investment in NSW retail property fell to $213 million in the first quarter of 2020, down 75.2 per cent from then fourth quarter of 2019 while investment in industrial assets did not fall to the same extent as other asset types, limited stock availability continued to hamper sales volumes.

Industrial investment also fell to $261 million in the first quarter of 2020, dipping by 57.1 per cent.