Rising Mortgage Arrears Predicted to Keep Going Up

Mortgage arrears are at their highest point since the start of the pandemic as experts predict it will only get worse for borrowers.

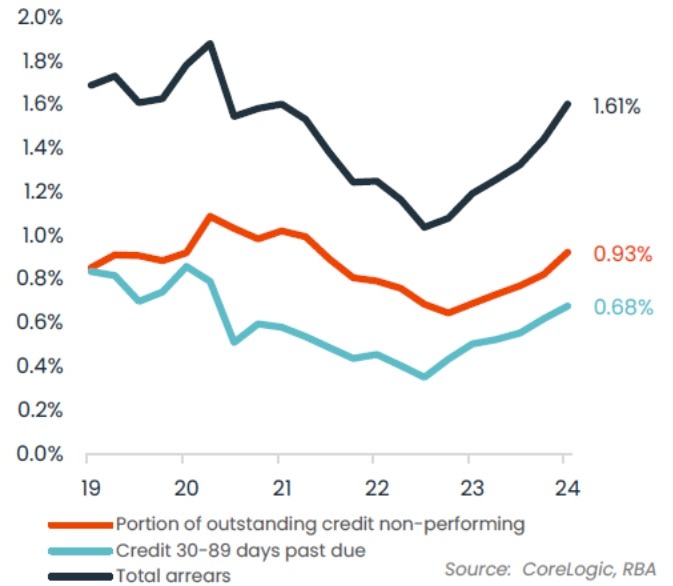

At the onset of Covid arrears reached 1.8 per cent, then dipped to 1 per cent in mid-2022 before rising again to 1.6 per cent in the March quarter of 2024, according to CoreLogic research.

Non-performing loans, those 90 days past due or worse, reached 0.93 per cent of all loans, slightly higher than at the onset of Covid, 0.92 per cent, and above the series average of 0.86 per cent.

Meanwhile, repayments 30 to 89 days overdue were 0.68 per cent of loans, well above the series average of 0.59 per cent of the past five years.

CoreLogic Australia research director Time Lawless said a key factor in higher mortgage arrears was, naturally, the sharp rise in the cost of debt.

“The average variable interest rate on outstanding owner-occupier home loans rose from 2.86 per cent in April, 2022 to 6.39 per cent in March, 2024,” Lawless said.

“So a borrower with $750,000 of debt would be paying nearly $1600 more each month on their scheduled repayments.”

Mortgage arrears, May 2024

But there are other factors at play, including cost of living pressures, increasing taxes, adjustments in interest rates and loosening labour market conditions.

Lawless said although each measure of mortgage arrears rose to above the series average most borrowers kept on track with their home loan repayments.

“They did this by drawing down on their savings, working more hours or multiple jobs, and contributing less to mortgage offsets or redrawn facilities,” Lawless said.

“It was likely mortgage arrears would rise further as unemployment lifted, household savings depleted further and, more broadly, economic conditions navigated a period of weakness.

“However, arrears were unlikely to experience a material blow out unless labour markets weaken substantially more than forecast.”

For home owners who fall behind on their repayments, there was a good chance most would be able to sell their asset and clear their debt.

The latest estimates on negative equity from the RBA revealed only around 1 per cent of homes across Australia would have a debt level higher than the value of the home.

With housing values continuing to rise, the risk of negative equity was reducing.

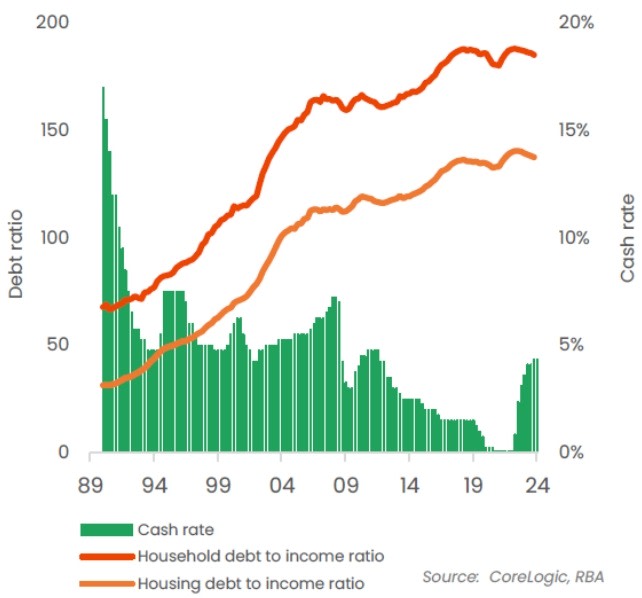

Housing/household debt ratios v interest rates

Another factor in low mortgage arrears was likely to be a history of strong underwriting standards from Australian lenders and the prudential regulator APRA.

Borrower serviceability continued to be assessed at a mortgage rate 3.0 percentage points higher than the loan product rate, as has been the case since October, 2021 when APRA lifted the serviceability buffer from 2.5 percentage points.

Most borrowers who took out a home loan between late 2019 and mid-2022 would have seen their mortgage rate rise more than three percentage points.

This reflected a combination of very low interest rates leading into and during the pandemic, but also the 3.5 percentage point rise in outstanding variable mortgage rates since May, 2022.

Lawless said household balance sheets were being tested, especially for those who may have had more leverage or seen a change in their financial circumstances.

“We’ve also seen a tightening of lending policies for what APRA might describe as riskier types of lending: interest only loans, and loans with high debt to income ratios, high loan to income ratios or high loan to valuation ratios,” Lawless said.

“This type of lending was generally skewed towards investors and would generally convert to a principal and interest repayment schedule after a period of time.”

Interest only loan originations have mostly held below 20 per cent of mortgage originations since late 2017.

Before that, interest only lending was as high as 45 per cent of all loan originations, prompting APRA to introduce a temporary macroprudential constraint limiting interest only loans to 30 per cent of originations.

That policy was removed in 2018, but lenders have kept originations well below the historical cap since that time.

The recent rise in interest only lending activity aligns with a substantial pick up in investor activity, where the value of new lending is up 36 per cent over the past year.

High loan to income ratio lending has shown a subtle rise from the series low in mid-2023 but remained very low by historical standards.

APRA data showed just 3.1 per cent of loans originated in the March quarter had a credit limit greater than or equal to six times the annual income of the borrower, down from 11.1 per cent of originations in the final quarter of 2021.

High debt to income ratio lending was at a series low in the March quarter, comprising just 5.2 per cent of home loan originations, down from the final quarter of 2021 when 24.3 per cent of new lending was to borrowers with an overall debt level at least six times higher than their gross annual income.

The portion of home loans originating with a deposit of 10 per cent or less have risen a little but still comprise less than 8 per cent of originations for owner occupiers and just 3.2 per cent of originations for investors.

Analysis from the RBA shows high LVR loans have recorded higher mortgage arrears than other categories of lending.

Lawless said overall lending policies across Australia remained relatively conservative.

“Close to 70 per cent of borrowers obtaining housing credit with at least a 20 per cent deposit and where their loan amount or overall debt profile is less than six times their gross annual income,” he said.

“It’s likely lending policies will remain fairly cautious as the economy navigates a period of weakness punctuated by high interest rates and stubborn cost of living pressures.”