Renters on Top as Housing Prices Fall: REIA

June quarter figures reflect a changing dynamic in the property market as real estate prices drop in major capital cities, and its renters who are coming out on top, new research shows.

Property prices across Australia’s capital cities fell in the June quarter with the weighted average median prices dropping by 0.8 per cent for houses and 0.3 per cent for other dwellings, according to the Real Estate Institute of Australia.

The Real Estate Market Facts report shows the weighted average median price for houses decreased to $765,098, and $590,935 for all other dwellings.

Prices for houses dropped in all capital cities except for Brisbane, Adelaide and Hobart.

While prices for attached dwellings dropped in all capital cities except for Melbourne, Brisbane, Hobart and Darwin.

Related: Brisbane Leading the Nation in Property Performance Indicators, But Boom Talk Premature

The latest Corelogic data shows residential property values fell over the past 12 months in Sydney (-5.6 per cent), Melbourne (-1.7 per cent), Perth (-2.1 per cent) and Darwin (-4 per cent).

While Brisbane (+0.9 per cent), Adelaide (+1 per cent), Hobart (+10.7 per cent) and Canberra (+2.3 per cent) experienced property price rises.

Brisbane stands out from the pack as a top capital city performer.

BIS Oxford Economics described Brisbane as a "surprise performer" in its recent report, with expected house price growth of 2 to 3 per cent to 2019-20, before greater growth of six per cent forecast in 2020-21.

Related: Improved Housing Affordability Short Lived: Report

Rental affordability has also improved in Brisbane among other capital cities.

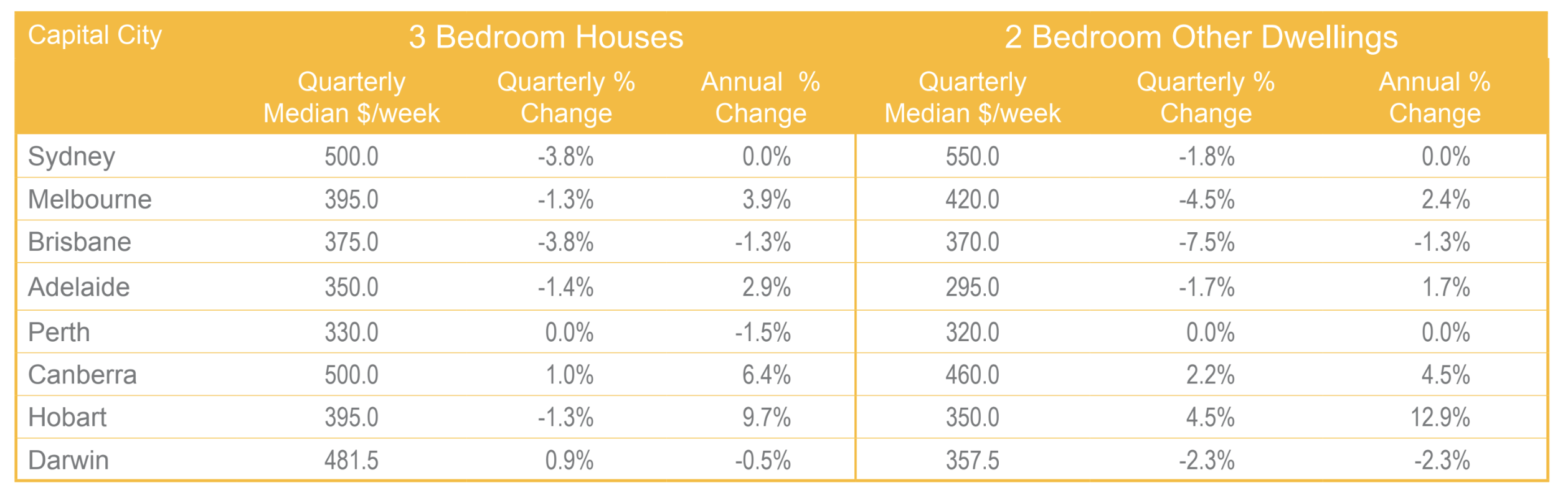

In good news for renters, REIA president Malcolm Gunning said the median rent for three-bedroom houses also dropped in capital cities Sydney, Melbourne, Adelaide and Hobart.

“The median rent for two-bedroom other dwellings increased in Canberra and Hobart, remained steady in Perth and decreased in Sydney, Melbourne, Brisbane, Adelaide and Darwin,” Gunning said.